The biotech sector is notorious for being either “Risk On” or “Risk Off.” And nothing in between.

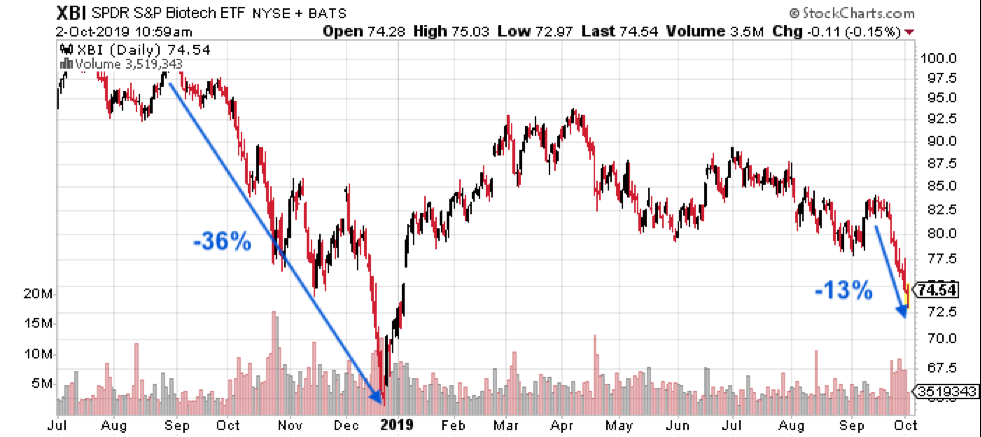

We experienced this firsthand in 2018, when the SPDR S&P Biotech Index dropped 36% from September to late December.

You’ll recall, the selling was indiscriminate and got completely detached from the fundamentals.

At the time, I wrote:

“Nary a small biotech has been able to escape the latest rout. So much so a staggering 22.3% of microcap biotechs (60 out of 269) are trading for less than cash on the balance sheet. If you believe a dollar is ultimately worth a dollar, these stock valuations are destined to rebound on that fact alone.”

That’s the key – steep downdrafts and disconnects in biotech are typically followed by prolonged periods of rising prices. Not to mention, the biotech market turns on a dime. (Hallelujah!)

Why bring this up? Because it appears we might be headed into another biotech freeze. Consider:

- With today’s 2% drop to start the day, the biotech index is down eight trading days in a row (and counting).

- In terms of percentages, biotech is down 13% from the mid-September high. That compares to only a 3% pullback for the S&P 500 Index.

- Once again, the selling is indiscriminate. In other words, it’s not just Provention Bio (PRVB) and Cue Biopharma (CUE) getting hit. Every biotech is taking it on the chin.

Instead of sitting back, sticking to our convictions and idly waiting out another potential storm, it’s time to consider a hedge.

Here’s what I recommend…

This content is reserved for subscribers. Want to know what the future looks like? Thinking of investing in new tech trends and companies before they become household names? Then consider subscribing here. We provide ongoing intelligence on emerging technologies and the best direct investments.