When The Smartphone Dies:

A fresh $198 billion technology boom is racing towards an inflection point and will ultimately dwarf the smartphone revolution. And we’ve found the most compelling micro-cap company to capitalize on the trend…

Set your calendars for April 2022. That’s the month and year that the next futuristic consumer tech device officially goes mainstream… and the smartphone officially dies.

At least that’s what a top scientist at Facebook predicted. And I agree — give or take a month or two!

In all seriousness, it might come as a shock to longtime readers that I’m calling for the end of the smartphone boom.

After all, for the better part of the last decade, I’ve boldly proclaimed, “The exploding use of mobile devices promises to be the fastest-growing — and possibly biggest — technological trend ever.”

But the data don’t lie. And in this case, the trend is officially dead.

Consider: Smartphone adoption in the United States is at roughly 80%. And the last 20% never comes easily, quickly, or profitably — especially for investors.

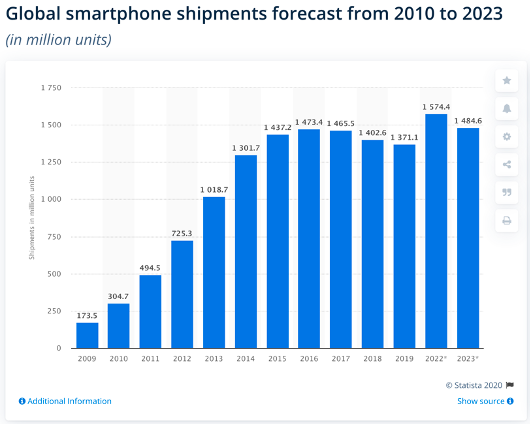

Moreover, global smartphone sales peaked years ago (2016), as you can see in the chart below. And the dynamics of the market now resemble the PC market, which peaked in 2011 and then steadily declined every year thereafter.

I’m sorry, but if a tech trend isn’t growing at a healthy double-digit clip, it’s dying.

In this case, we can forget about any technological leapfrogs — like multitouch interfaces or fingerprint sensors — resurrecting smartphone growth like they did in the past.

Why? Because true smartphone innovation is dead, too. If you have any doubt, pick up the latest devices from Samsung, Apple, and Huawei. You’ll notice very few differences. Consequently, all that’s left is the potential for incremental improvements.

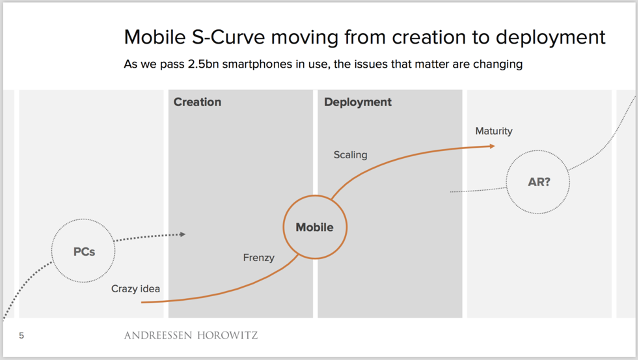

We’re just at that point in the irrefutable cycle of technology development and adoption for smartphones. Or as leading venture capitalist Benedict Evans explains:

“New technology of any kind tends to follow an S-curve. At first, improvement and innovation seems slow as the fundamental concepts are worked out. Then there’s a period of very rapid change, innovation and feature expansion. And then, as the market matures and the “white space” is filled in, perceptible improvement tends to slow down.”

So we’ve clearly reached “peak” innovation for smartphones — which begs the question, “What’s next?”

Newsflash: We don’t need to guess.

If we simply follow the words and actions of the world’s top technology companies and investors, there’s no mistaking it. They’re all betting big that augmented reality (AR) will be the next “big thing.”

In fact, as a columnist for Forbes recently proclaimed, “Every major tech company is now working on smart glasses.”

He’s not kidding, either. Consider:

- Google, after being way too early, recently re-entered the space by purchasing North, a Canadian maker of light, natural-looking smart glasses. In other words, the exact opposite of Google’s original AR product.

- Last month, Facebook went public with its plans for its “holographic optics for thin and lightweight virtual reality” in a research report.

- Intel’s been messing with developing “normal” looking smart glasses for years.

- Amazon’s has Amazon Echo Frames.

- Microsoft has Hololens.

- And of course, Apple is now widely known to be working on its own version of AR glasses, based on its patent filings. (Here’s a recent example).

Add it up and it’s a foregone conclusion based on the actions of the big tech companies that AR devices are on a trajectory to be as indispensable to us as smartphones.

In turn, it makes eminent sense that we should be betting big on AR, too. Based on the S-curve, AR is at the first stages of creation — on the cusp of the “frenzy” period.

As I’ve shared before, this is the optimal time to invest (i.e., when the potential gains are the highest). In this case, it coincides with a $198 billion massive growth boom kicking into high gear.

Once again, we’re shunning the boring, watered down large cap plays in the space because we’ve identified an under-the-radar, pure-play, tiny $165 million market cap company that’s actually two to three years ahead of all the tech giants.

This content is reserved for subscribers. To gain immediate access to our 100% independent research on the top tech trends and companies before they become household names, consider subscribing here.

For a limited time only you can use Coupon Code DTR50 to receive 50% off a quarterly or annual subscription.